XRP Price USD: What Impact Will Global Regulation Have on Its Value?

XRP, the digital currency created by Ripple Labs, has long been a subject of intense discussion in the world of cryptocurrencies. As the market for digital assets continues to grow, XRP stands out due to its focus on facilitating fast and low-cost cross-border payments. But just as with any digital currency, the price of XRP in USD (XRP Price USD) is influenced by a wide range of factors. Among the most pressing is the role of global regulation, which can significantly shape its future value.

In this article, we will explore how global regulations can affect the XRP price USD, focusing on its potential impact on adoption, market demand, and investor sentiment. We will also take a closer look at the relationship between XRP price USDT and its performance against other stablecoins like USDT.

Understanding XRP and Its Market Dynamics

XRP, unlike Bitcoin or Ethereum, is not mined. It is designed to serve as a bridge currency for financial institutions, enabling them to settle transactions quickly and efficiently. Its primary use case revolves around cross-border payments, which can be slow and costly using traditional banking systems. XRP was created to address these issues and is heavily integrated into Ripple’s payment platform, RippleNet.

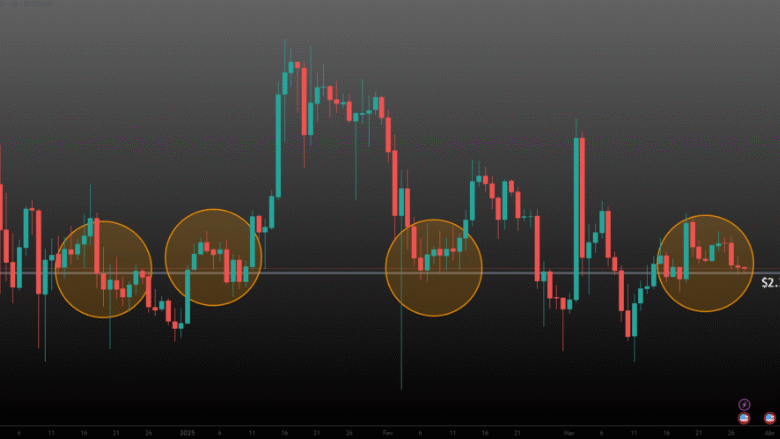

Over the years, XRP has experienced significant volatility, much like other cryptocurrencies. The price of XRP is typically quoted in terms of USD (XRP Price USD), though it is also frequently traded against stablecoins like USDT (Tether). XRP’s price is subject to a variety of factors, including market sentiment, adoption by financial institutions, and, importantly, regulatory frameworks in different regions.

The Role of Regulation in Cryptocurrencies

Cryptocurrencies, by their very nature, operate in a decentralized environment. However, this decentralized ethos does not mean that they are free from scrutiny or regulation. As more governments recognize the potential of digital currencies and blockchain technology, they are increasingly moving to regulate them. This regulatory landscape can have a significant impact on the price of XRP and other cryptocurrencies.

Global regulatory bodies such as the U.S. Securities and Exchange Commission (SEC) and the European Union have begun introducing measures to provide clarity around the legal status of cryptocurrencies. These regulations aim to protect investors, prevent money laundering, and promote financial stability. However, they can also have unintended consequences, influencing market behavior and, in turn, the value of XRP.

How Global Regulation Affects XRP Price USD

1. Legal Clarity and Investor Confidence

One of the most direct impacts of global regulation on the XRP price USD is legal clarity. When a cryptocurrency like XRP is subject to clear and consistent regulatory guidelines, it reduces the uncertainty surrounding its future. For investors, this clarity can be crucial in making informed decisions about whether to buy or sell XRP.

For example, when the SEC filed a lawsuit against Ripple Labs, claiming that XRP was being sold as an unregistered security, the price of XRP fell sharply. This legal uncertainty caused many investors to pull out of their positions, and the XRP price USD experienced significant volatility. If global regulations were to resolve such legal issues, it would likely boost investor confidence, thereby increasing demand for XRP and stabilizing its price.

2. Compliance Costs and Market Adoption

Another critical factor that global regulations could influence is the cost of compliance for Ripple and other companies involved with XRP. Stricter regulations often require businesses to implement more robust anti-money laundering (AML) and know-your-customer (KYC) procedures. While this might make XRP more appealing to institutional investors, it could also increase operational costs for Ripple Labs and its partners.

If Ripple is required to spend more resources on compliance due to new regulations, this could limit its ability to invest in growing the XRP network, which may slow down its adoption by financial institutions. This could, in turn, impact the demand for XRP and the price in USD. On the other hand, if these regulations result in wider adoption by regulated financial institutions, the long-term demand for XRP may increase, leading to higher prices.

3. The Impact of Stablecoins Like USDT

Stablecoins like USDT (Tether) are pegged to traditional fiat currencies, often the U.S. Dollar, and are used to provide stability in the volatile cryptocurrency market. The relationship between XRP Price USD and stablecoins is a crucial one, as many traders and investors use stablecoins to hedge against price fluctuations in other cryptocurrencies.

If global regulations create a more stable and predictable environment for cryptocurrencies, the use of XRP as a bridge currency in global payments could increase, driving its price upward. However, if regulations favor stablecoins like USDT, which are often seen as less risky, XRP’s price might struggle to keep up. This competition between XRP and stablecoins could play a significant role in determining the long-term value of XRP in USD.

How Specific Regulations Could Impact XRP

1. U.S. SEC and Legal Battles

In the United States, the SEC has been at the forefront of regulating cryptocurrencies. The lawsuit against Ripple Labs has cast a shadow over XRP’s future, creating uncertainty in the market. If the SEC rules that XRP is a security, it could impose strict reporting requirements on Ripple Labs, potentially leading to reduced adoption and liquidity. On the other hand, if Ripple wins the case, it could pave the way for greater institutional adoption of XRP, positively influencing the XRP price USD.

2. European Union and MiCA Regulation

The European Union is working on the Markets in Crypto-Assets (MiCA) regulation, which aims to provide a comprehensive legal framework for cryptocurrencies in the region. MiCA could influence the XRP price USD by creating a more regulated environment for digital assets. If the regulation is favorable to XRP, it could encourage European financial institutions to adopt XRP as a payment solution, thus increasing its value.

3. Asian Markets and Regulatory Pushback

Asia has been a significant player in the cryptocurrency market, with countries like China, Japan, and South Korea playing important roles. However, these countries have different approaches to cryptocurrency regulation. For example, China has imposed strict bans on cryptocurrency trading, while Japan has created a regulatory framework that allows for greater adoption.

As global regulatory trends shift, the price of XRP in USD could be influenced by how Asian markets respond to these changes. Positive regulations in Asia could lead to increased demand for XRP, while harsh regulations could limit its growth prospects in the region.

The Future Outlook for XRP Price USD and Regulation

1. Increased Regulation = Increased Trust?

Despite the initial volatility caused by legal challenges, the increasing trend of regulation could ultimately help XRP. As governments and regulatory bodies create clearer and more standardized rules for digital assets, cryptocurrencies like XRP could become more trusted in mainstream financial systems. This could lead to more use cases, such as its adoption by banks and payment providers, boosting demand and stabilizing the XRP price USD.

2. Regulatory Uncertainty: A Double-Edged Sword

While regulations can drive growth in the long run, the process of implementing and adapting to these rules may cause short-term volatility. As regulatory bodies fine-tune their approaches to digital assets, the price of XRP could experience fluctuations based on news and updates. However, a favorable resolution in the regulatory landscape could trigger positive momentum for the XRP market.

Conclusion: What Will the Future Hold for XRP Price USD?

The impact of global regulation on XRP’s value is profound, with both short-term and long-term implications for its price in USD. As the regulatory environment continues to evolve, XRP’s future is highly dependent on how governments around the world approach cryptocurrencies. Legal clarity, compliance costs, and the competition with stablecoins like USDT will all play a role in determining the future trajectory of XRP.

If the regulations favor XRP’s use in cross-border payments and financial applications, the demand for XRP could rise, driving its value upward. However, if regulations pose significant hurdles, the price of XRP might struggle to maintain upward momentum. Ultimately, the future of XRP will be shaped by how Ripple Labs and the broader cryptocurrency market navigate these regulatory challenges.

Frequently Asked Questions (FAQ)

1. What is XRP?

XRP is a digital currency designed to facilitate fast and low-cost cross-border payments. It is primarily used within the Ripple network and is not mined like Bitcoin. Its value fluctuates based on market demand, regulatory changes, and adoption by financial institutions.

2. How does global regulation affect XRP’s price?

Global regulations can provide legal clarity, boost investor confidence, and foster wider adoption of XRP. Conversely, regulatory uncertainty can lead to market volatility and price fluctuations, as seen in Ripple’s ongoing legal battle with the SEC.

3. Will XRP benefit from global cryptocurrency regulations?

If global regulations support XRP’s use in cross-border payments and reduce legal uncertainties, it could benefit from wider adoption, increasing its price. However, if regulations impose heavy compliance burdens or restrict its use, XRP could face challenges.

4. What is the relationship between XRP price USD and USDT?

XRP Price USD and USDT are often compared in the cryptocurrency market. While USDT offers stability due to its peg to the U.S. Dollar, XRP serves as a bridge currency in cross-border transactions. Regulatory changes could impact their relative values depending on the adoption and use cases of each.

5. How will XRP’s price react to future legal outcomes in the U.S.?

The outcome of the SEC lawsuit against Ripple will significantly impact XRP’s price. If Ripple wins, XRP’s legal status will be clearer, potentially increasing investor confidence. If Ripple loses, it could face heavy regulatory burdens, reducing market liquidity.

6. What are the main factors influencing XRP price in USD?

The key factors include legal clarity, market adoption by financial institutions, regulatory developments, investor sentiment, and competition from other cryptocurrencies and stablecoins like USDT.